As well as, play with sheets which can be the same dimensions because the variations and you may times and you will mean demonstrably the newest line amount of the fresh published function to which all the information relates. The fresh fiduciary is needed to give a plan K-step 1 (541) every single recipient just who obtains a shipment out of possessions or an enthusiastic allowance from an item of the fresh estate. A penalty from $one hundred per recipient (never to surpass $1,five-hundred,100 for your season) was implemented on the fiduciary if it demands isn’t came across. Anyone who try paid back to set up a taxation get back need sign the fresh get back and you may complete the “Repaid Preparer’s Use only” an element of the go back.

- It may also getting beneficial to posting a change-aside list of the things that must be cleared, and the rates for each item if the property owner should brush otherwise resolve the object rather.

- To own aim aside from calculating your own tax, you happen to be handled while the a You.S. citizen.

- Most name put team need thirty days’s see try a customers must withdraw finance early.

- Numerous nonprofits and you can personal functions firms offer advice about protection places or any other swinging costs, including the Salvation Military, Catholic Charities, and St. Vincent de Paul.

- Here’s an in depth report on exactly what’s started guaranteed, what’s currently going on, just in case the newest relief you are going to finally come to those in you would like.

Have fun with Income tax Worksheet (Discover Tips Less than) – greedy servants online uk

Group from the libraries and you will post offices don’t offer taxation guidance or guidance. Really article organizations and you will libraries offer 100 percent free Ca income tax booklets while in the the fresh processing season. The brand new amounts moved of Agenda G, line F and you may column H, is always to only were money and write-offs reportable so you can Ca. California doesn’t conform to accredited home business inventory acquire exception below IRC Part 1202. Are the investment development, even when marketed, that will be owing to earnings underneath the ruling instrument otherwise regional laws. If the matter on the Plan D (541), range 9, column (a) is an internet losings, get into -0-.

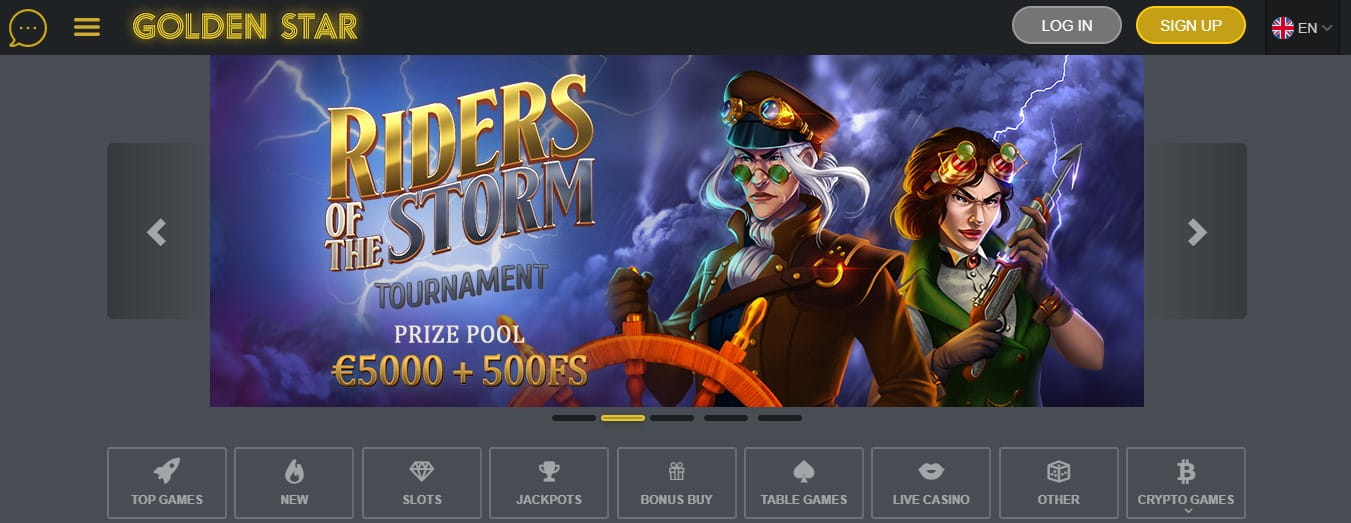

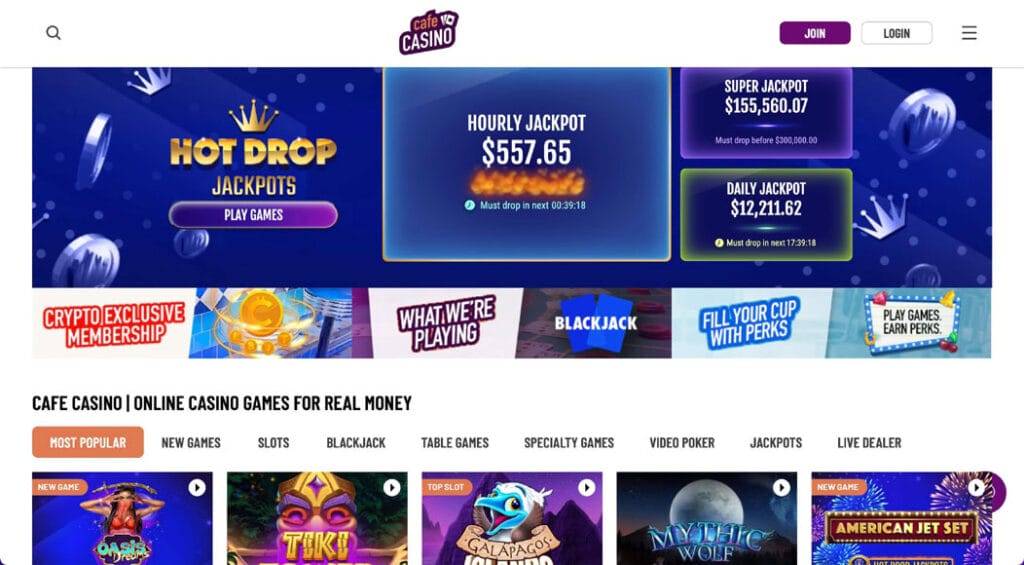

Online slots

Extremely states restriction how long you must communicate so it suggestions. If you can, offer your new mailing target to your landlord otherwise property government business At the earliest opportunity. For many who wear’t features another address, give them a trusted address such as a great pal’s or a member of family’s address.

Paying rates of interest to the Defense Places

There is certainly a good $twelve monthly services commission which is waived if you have a great monthly head deposit out of $500+ or keep a minimum each day balance from $step 1,five-hundred otherwise have $5,000+ in any combination of being qualified Chase examining, savings, and other balances. To get the $300, discover a new membership, create, and place up and receive head dumps totaling $five-hundred or more in this 90 days. Immediately after all of the conditions try fulfilled, Financial from America will endeavour to spend the advantage in this 60 months. Your own $three hundred dollars bonus would be transferred into your account inside sixty days of conference conditions.

The new nonexempt greedy servants online uk part of one grant otherwise fellowship give that’s U.S. supply earnings try addressed because the effectively associated with a trade otherwise team in america. For more information, find Functions Performed for Overseas Workplace within the part step 3. The cash is addressed since the U.S. supply money when the an income tax away from less than 10% of the money regarding the product sales try paid in order to a different nation.

This article has not been assessed, approved if not recommended by some of these entities. One of his true favorite products (the following is my personal benefits chest away from systems, the thing i fool around with) try Encourage Personal Dash, enabling him to cope with his funds in just 15-moments per month. They also render monetary considered, including a retirement Considered Tool that may inform you if the you’re on track to retire when you want. Inside Computer system Science and you will Economics of Carnegie Mellon University, an enthusiastic Meters.S. Within the Information technology – App Engineering of Carnegie Mellon College or university, as well as a professionals running a business Management away from Johns Hopkins University.

Most of the time, landlords never charge for what is recognized as regular “damage.” Typical destroy to own regular have fun with is going to be requested, for example mild carpeting wreck, diminishing painting, and ageing equipment. For individuals who result in an excessive amount of problems such as gaps inside walls otherwise greatly discolored carpeting, you might be billed of these form of injuries.

The fresh cruising otherwise departure permit awarded within the conditions within part is for the particular deviation where it is given. Aliens in both of these classes who have maybe not recorded a keen tax return or paid tax for income tax year have to file the new go back and you may afford the tax ahead of it will likely be awarded a cruising or departure allow for the Function 2063. If you registered the united states while the a nonresident alien, however they are today a citizen alien, the newest pact different may still implement. See College students, Apprentices, Trainees, Coaches, Professors, and you will Experts Which Became Resident Aliens, after, lower than Citizen Aliens.

- Business loans might be used against “web tax” before almost every other credits.

- To learn more and the ways to sign up for a certificate from Exposure, see SSA.gov/international/CoC_link.html.

- Because of this, to have taxation ages beginning January step one, 2024, the above mentioned election will no longer be around for college students and trainees away from Hungary.

- Decline try an amount deducted to recoup the price or other base out of a trade otherwise team advantage.

Specific tax treaties also offer exceptions of income (or quicker taxation rates) to people one to be eligible for advantages beneath the taxation treaties. Earnings based on the new separate assets of a single partner (and you will that isn’t earned money, change or business income, otherwise union distributive show money) is actually handled as the income of the mate. Make use of the appropriate area possessions laws to determine what are separate possessions.

Make use of it on condition that the brand new lease finishes or you has to evict anyone. Handling protection dumps intelligently is key to a profitable rental company. It’s regarding the finding the best harmony ranging from protecting your house and you can maintaining a confident renter relationship.

Range step 1 – Focus income

To choose for those who meet up with the nice presence test to own 2024, matter a complete 120 days of exposure within the 2024, 40 weeks inside the 2023 (1/step three out of 120), and 20 months within the 2022 (1/six of 120). As the full to the 3-year several months is actually 180 days, you’re not sensed a citizen underneath the generous exposure sample to own 2024. When you are a keen alien (perhaps not a great You.S. citizen), you’re thought a good nonresident alien unless you see one of both screening explained below Citizen Aliens lower than.

Acquire or loss in the sales or exchange away from personal assets fundamentally has its own supply in the united states when you yourself have a taxation house in the usa. Unless you provides a tax home regarding the Joined Claims, the fresh acquire otherwise loss could be considered from supply outside of the United states. Gross income of supply in america boasts growth, profits, and you will income in the sales or other mood from property located in the Us. The above mentioned perimeter professionals, apart from taxation compensation and dangerous or difficulty duty pay, try sourced according to your principal work environment. Your own dominating place of work is often the lay the place you purchase much of your functioning day. This can be your office, plant, store, store, or other place.

The brand new You.S. income tax go back you ought to file because the a dual-position alien depends on regardless if you are a resident alien or a nonresident alien at the end of the newest tax season. Earnings away from U.S. offer is actually taxable if you will get they while you are a good nonresident alien otherwise a citizen alien except if specifically excused within the Inner Revenue Code otherwise a tax treaty provision. Fundamentally, taxation treaty specifications pertain only to the newest the main season you were an excellent nonresident. Sometimes, yet not, treaty provisions can get pertain when you were a resident alien.

A desire for a foreign corporation owning You.S. real property can be perhaps not a You.S. real estate interest unless the corporation decides to become treated because the a domestic firm. To possess deals in the brings or bonds, so it relates to one nonresident alien, in addition to a supplier otherwise representative in the holds and bonds. Money of any kind that is exempt of You.S. income tax lower than an excellent treaty to which the us try a good team is actually excluded out of your gross income. Income about what the new income tax is simply for pact, although not, is roofed within the gross income. If you were paid by a foreign workplace, their You.S. supply income could be exempt from U.S. taxation, however, only if your see one of the items talked about next. So you can be considered as the portfolio focus, the interest have to be repaid to the financial obligation granted after July 18, 1984, and if you don’t at the mercy of withholding.